Mortgage Calculations

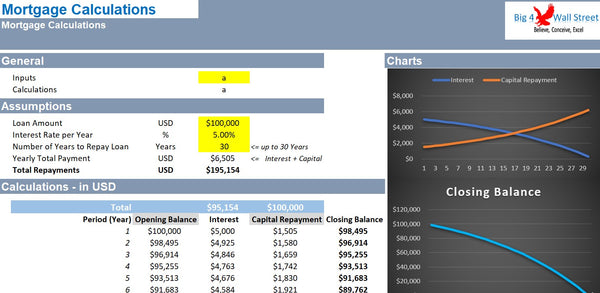

This excel file will allow you to calculate the interest and capital repayments of your mortgage based on the loan amount, the interest rate and the number of years to repay the loan.

The tool will allow you to calculate each period interest and capital repayments, as well as the closing balance of the loan amount at the end of each period.

A mortgage loan is used either by purchasers of real property to raise funds to buy real estate, or alternatively by existing property owners to raise funds for any purpose, while putting a lien on the property being mortgaged. The loan is "secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms.

Mortgage borrowers can be individuals mortgaging their home or they can be businesses mortgaging commercial property. The lender's rights over the secured property take priority over the borrower's other creditors, which means that if the borrower becomes bankrupt or insolvent, the other creditors will only be repaid the debts owed to them from a sale of the secured property if the mortgage lender is repaid in full first.

In many jurisdictions, it is normal for home purchases to be funded by a mortgage loan. Few individuals have enough savings or liquid funds to enable them to purchase property outright. In countries where the demand for home ownership is highest, strong domestic markets for mortgages have developed.