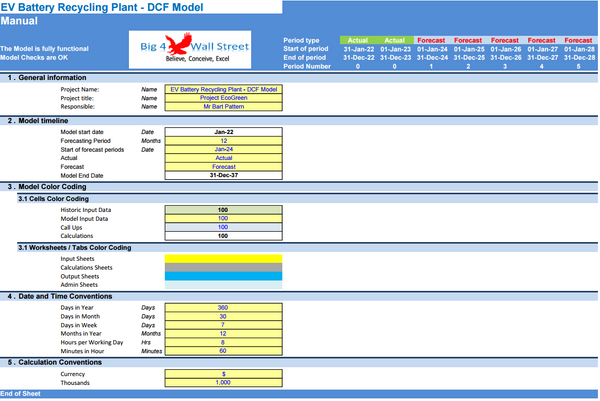

EV Battery Recycling Plant Financial Model (10+ Yrs DCF and Valuation)

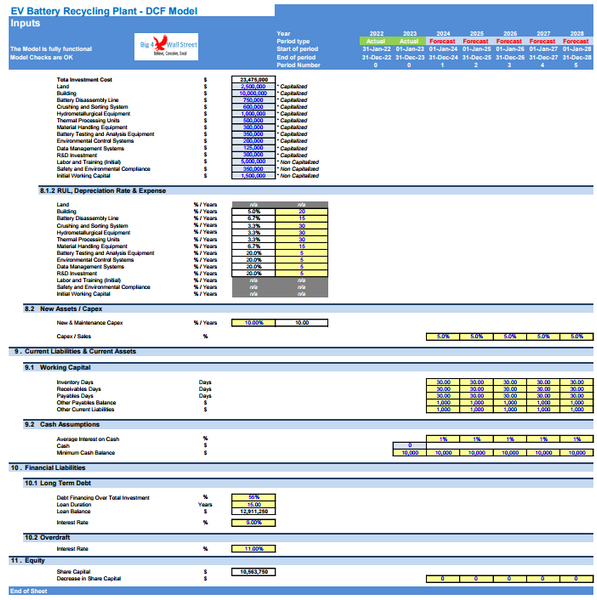

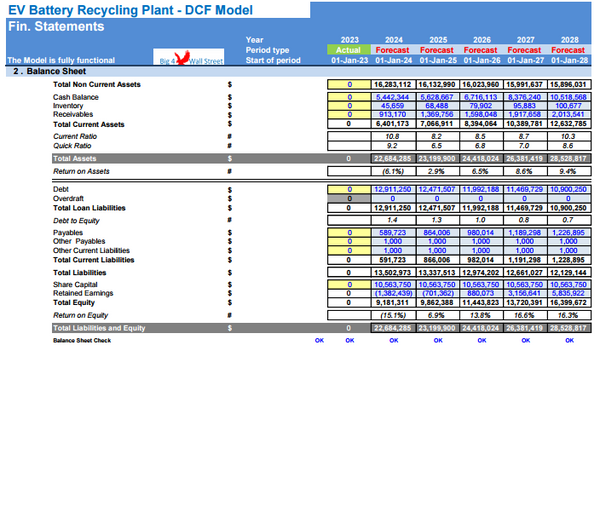

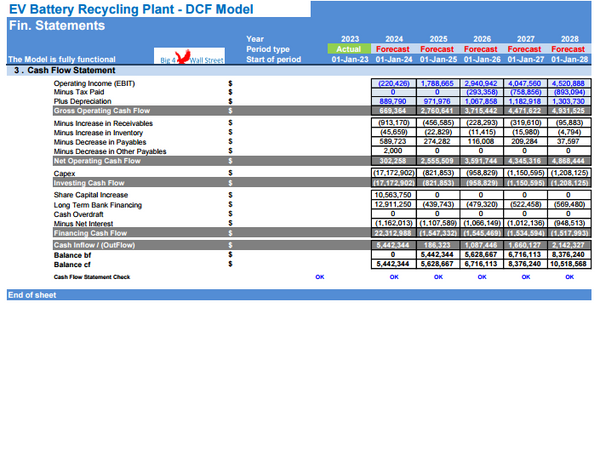

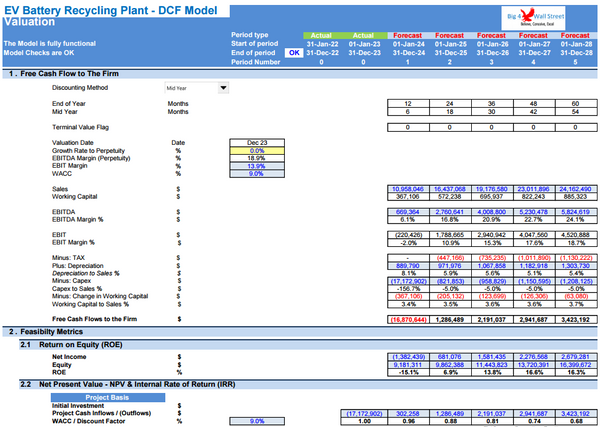

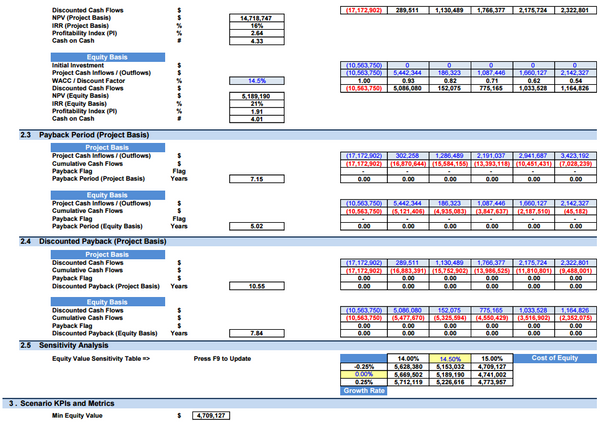

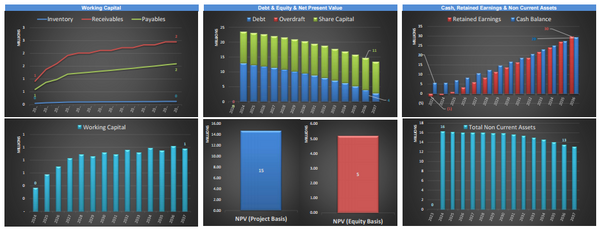

The EV Battery Recycling Plant financial model is a comprehensive tool designed to analyze the financial aspects of recycling electric vehicle batteries. It encompasses key components such as revenue streams, material recovery rates and financial projections. This model provides insights into the financial performance of the recycling plant, enabling informed decision-making, budgeting, sustainability assessment, and growth planning.

Key Components:

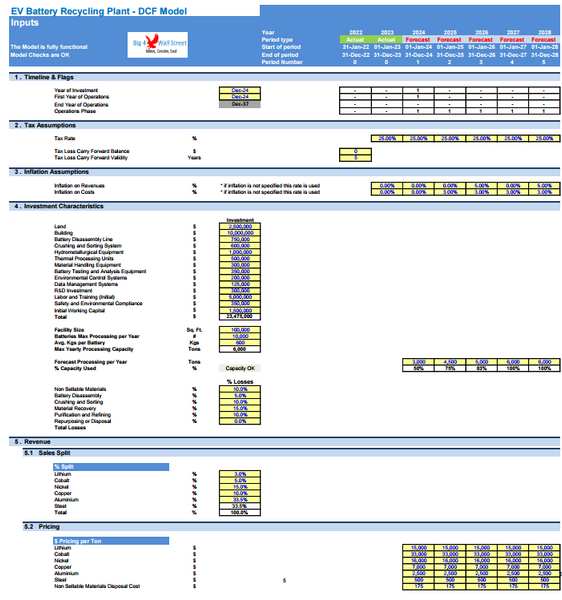

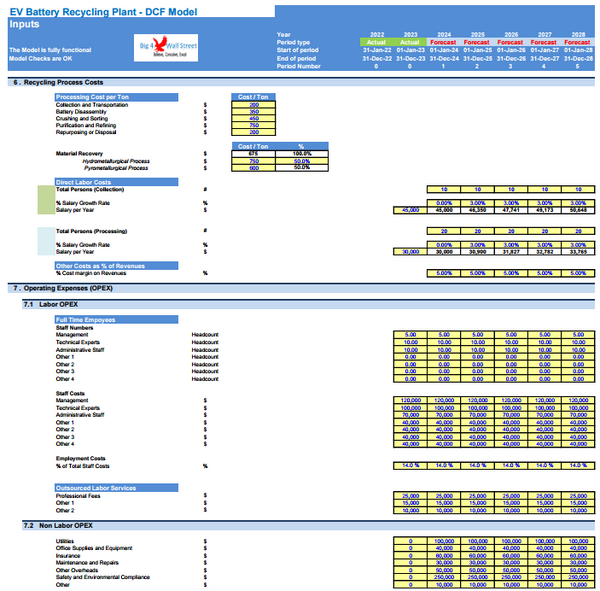

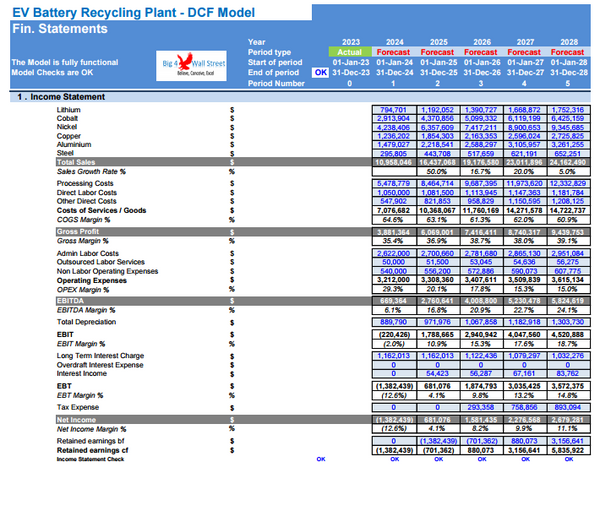

- Revenue Streams: The model assesses revenue sources from recycling processes, including recovered materials sales and disposal fees.

- Recycling Costs: It includes costs for collection, transportation, processing, and recycling of EV batteries, as well as operational expenses, labor, and regulatory compliance costs.

- Material Recovery Rates: The model estimates the rate at which valuable materials like lithium, cobalt, and nickel can be recovered from the batteries, influencing revenue and profitability.

Key Benefits:

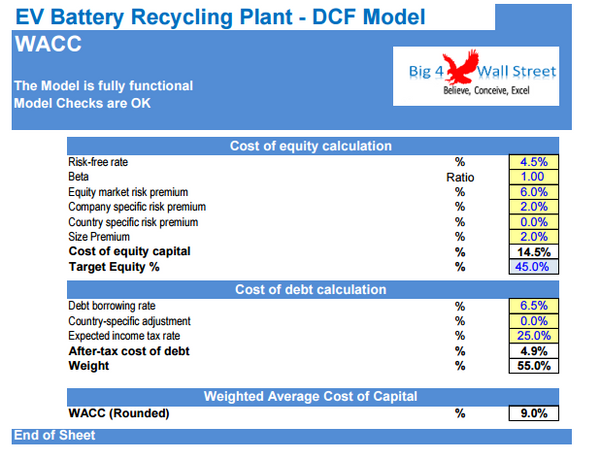

- Informed Decision Making: The EV Battery Recycling Plant financial model empowers stakeholders to make data-driven decisions regarding recycling processes, pricing strategies, material recovery methods, and resource allocation.

- Budgeting and Cost Control: By providing a comprehensive overview of expenses and potential revenues, the model assists in budgeting and cost control measures, ensuring financial sustainability.

- Sustainability Assessment: The financial model helps evaluate the environmental and economic sustainability of battery recycling, supporting responsible business practices.

- Growth Planning: Financial projections generated by the model support growth planning, allowing plant operators to assess the potential outcomes of expanding recycling capacity, improving efficiency, or entering new markets.

In summary, the EV Battery Recycling Plant financial model offers valuable insights into the financial performance and sustainability of a battery recycling facility. It supports informed decision-making, budgeting, sustainability assessment, and growth planning, all of which contribute to the success and environmental impact of the recycling plant.